2019 Laser Market Data

2019 Market for Lasers and Laser Systems for Materials Processing

Published 10th January 2020

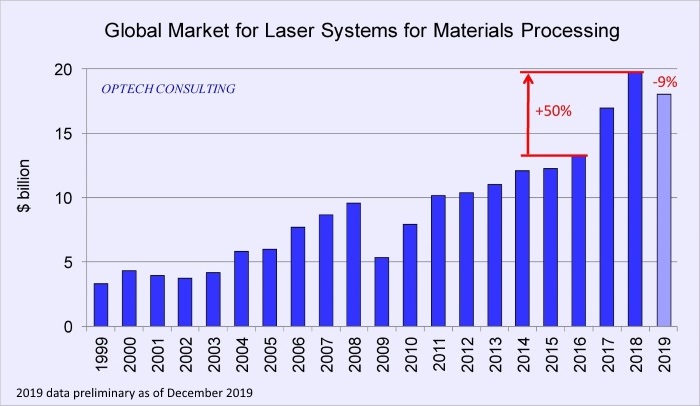

2019 Laser Materials Processing Systems Market Reaches $ 17.9 billion, Down 9%

The global market for laser systems for materials processing reached a volume of $ 17.9 billion in 2019, down 9% vs the previous year. The 2019 market estimate is based on data for the first three quarters and company guidances for the fourth quarter. The decrease in 2019 follows nine years of continued growth. The industrial laser systems market grew from $ 5.3 billion in 2009 to a record volume of $ 19.8 billion in 2018. In 2017 and 2018 alone the market increased by 50% due to a combination of drivers including the rapid adoption of laser manufacturing in China, a market push by decreased laser prices, and an end market pull in the consumer electronics and automotive industry.

In 2019, the macroeconomic environment deteriorated. According to the International Monetary Fund global GDP growth was down to 3.0% in 2019 vs 3.6% in 2018. The corresponding World Bank figures are 2.4% in 2019 and 3.0% in 2018. Major end industries for laser systems cut their equipment spending, notably smartphone makers and car manufacturers. The downturn in spending for laser equipment can also be seen as a correction after years of strong growth. The factory floors are well equipped with new laser technology, and given the decreased economic growth expectations less equipment was purchased in 2019.

Looking at China, the country has become the largest market for laser materials processing equipment with a 30% share in worldwide demand. Due its large share in global industrial manufacturing China’s leading position in laser equipment consumption is well justified. Moreover, the country is rapidly building its own laser industry. The share of imported laser equipment is decreasing, resulting in reduced export growth opportunities for equipment manufacturers outside China.

Often discussed, the USA China trade row and the associated tariffs have a detrimental effect on the laser equipment market. The resulting decreased global economic growth weighs also on the laser equipment market. Some of the overseas manufacturing investments in Asia are being shifted from China to neighboring countries, thus reducing laser equipment demand in China, but also creating export opportunities elsewhere, including for laser equipment manufacturers in China.

Looking ahead into 2020, the repeatedly downward revised GDP growth forecasts and the uncertainties in the important consumer electronics and automotive industry weigh on revenue expectations for the laser sector. The presently available data indicates that first quarter 2020 revenues will be clearly down year-on-year. We will update our view on the full year 2020 when more data becomes available.