2021 Laser Market Data

Industrial Laser and System Markets Reach New Record Highs in 2021

Increase of 22% According to Preliminary Estimate

01 February 2022

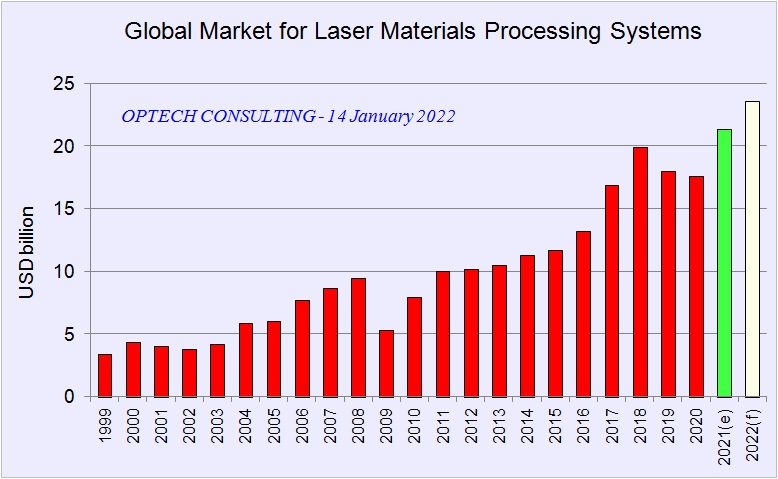

The global market for laser materials processing systems accounted for 21.3 billion USD in 2021, up 22% vs the 17.4 USD reached in 2020. The worldwide market for laser sources for materials processing accounted for USD 5.2 billion in 2021, up from USD 4.3 billion in the year before. These estimates are based on the data available by January 2022, which includes company financials for the first three quarters.

For 2022, the market for industrial lasers and laser systems is expected to grow at a rate slightly above the 10% mark. For the years to 2026 growth rates high single digit growth rates are expected. The forecasts are based on a steady economic environment.

Background to market forecasts The 2022 forecast is based on a steady macro-economic environment, which is forecast in the range of 4% to 5% (IMF, October 2021: 4.9%; World Bank, January 2022: 4.1%) and an inflation rate in the range of 2.5%. While global GDP growth is inflation adjusted, the laser systems market data is in nominal US dollars. The forecast to 2026 follows the expectation of a further steady economic environment and decreasing inflation rates (World Bank, IMF). It has to be noted that the industrial laser systems market is strongly pro-cyclical and has decreased by more than 40% in the past during economic downturns such as in 2009. It took two to three years for the market to recover from such a downturn.

Market and Market Growth for Laser Systems for Materials Processing

All major end industries for industrial laser systems contributed to the strong growth in 2021: electronics, automotive, and general metal processing. While capital equipment spending in the automotive sector still suffers from weak car sales, investments into e-mobility continue and also spur the demand for laser systems. The electronics segment took advantage from increased demand for electronic devices during the pandemic.

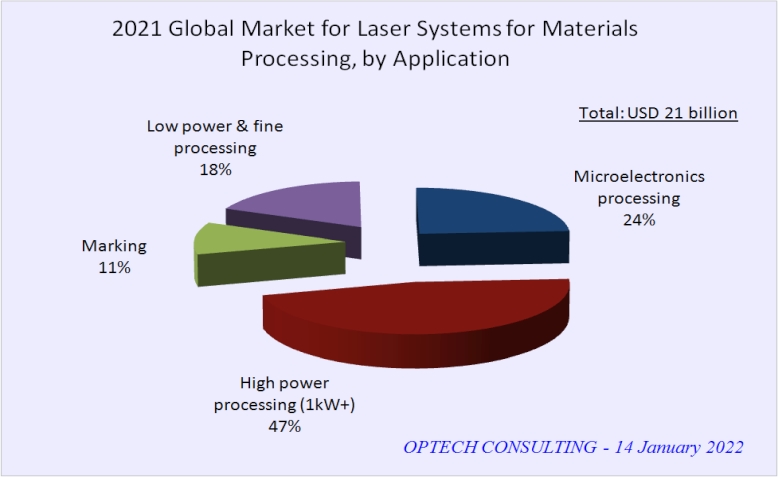

By application, high power laser cutting and welding systems hold by far the largest share of nearly half of the market, followed by laser systems used in microelectronics manufacturing, in low power and fine processing, and marking.

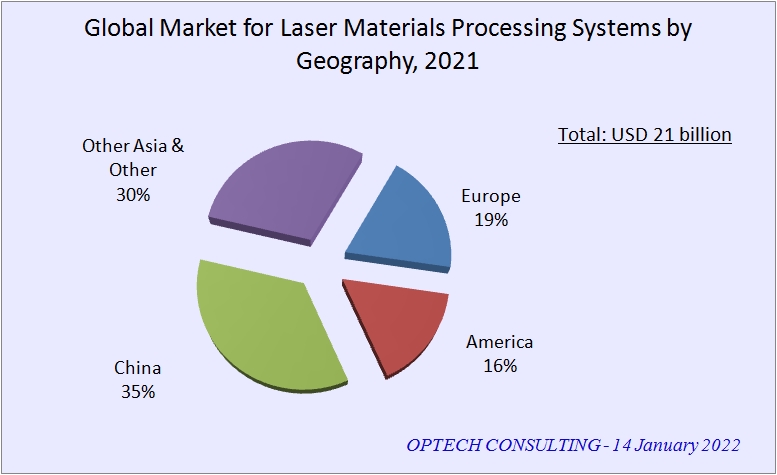

Laser Systems Market Segmentation by Geography

Especially strong sales growth in the range of 25% to more than 50% was reported for the first nine months in 2021 by several laser system manufacturers in Asia. For 2021, preliminary estimates indicate that 65% of the demand for laser materials processing systems is now located in Asia. China alone consumes 35% of all industrial laser systems. The share of America and Europe combined is 35%.

The large share of china is not surprising given the country’s share in global industrial manufacturing, and especially in the laser relevant industries. In 2021, the value of goods exported from China surged by 30%. Exported products are a major driver of laser-based manufacturing in China. In the last decade, the manufacturing industry in China rapidly adopted laser processes. Another major market driver in China in recent years was the availability of low cost systems, especially for marking and cutting, which lead to surging unit sales.

Market Details for Industrial Lasers

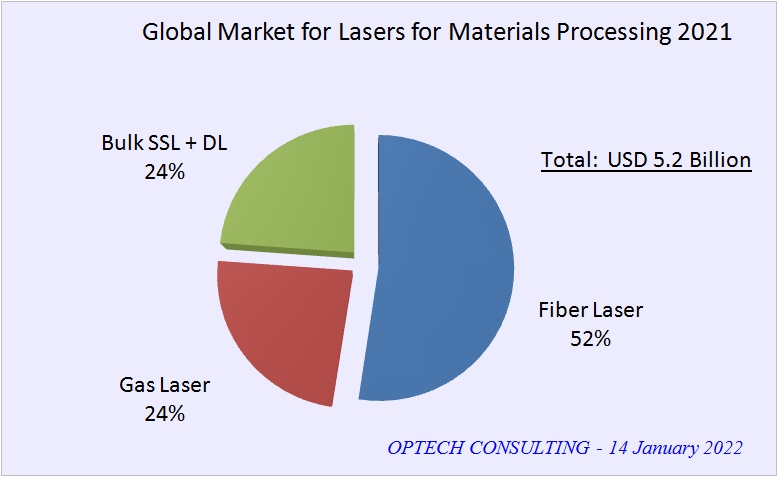

Laser oscillators for materials processing account for a global market of 5.2 billion US dollars for 2021, which corresponds to about 25% of the volume of the laser machine market (USD 21.3 billion). The figures for 2021 are preliminary estimates based on data for the first three quarters of the year. Fiber lasers account for about 52% of the total, including high power cw lasers, low power cw and quasi cw lasers, as well as short and ultrashort pulsed lasers. Gas lasers account for about one quarter of the market, bulk solid state and diode lasers make up for the remaining about one quarter.

Within the last ten years, the share of fiber lasers increased from 15% to more than 50%. High power fiber lasers, with an average power of 1 kW and above, account for more than 70% of the industrial fiber laser market. 6 kW fiber lasers are widely used now for flat sheet metal cutting, and a substantial number of flat sheet cutters is being equipped lasers of 10 kW and above.

The prices of kW class fiber lasers dropped by 70% during the last five years (comparing prices for the same power level). In China, low-cost fiber lasers are offered even at half the decreased price. Low-cost fiber lasers are widely used for equipping low-cost systems addressing cost-sensitive applications, which resulted in surging unit sales.

The gas laser segment includes CO2 lasers and excimer lasers. Excimer lasers are mainly used in microelectronics processing, including for annealing and DUV lithography. The CO2 segment comprises low power lasers mainly for non-metal processing, high power lasers for metal cutting and welding, as well as high power lasers for EUV generation.

The bulk solid state laser segment includes a large variety of lasers, from high power disk lasers for cutting and welding to low power nanosecond pulsed lasers of various wavelengths for marking and microelectronics processing, as well as ultrafast lasers with applications in microelectronics processing and in other sectors such as medical devices manufacturing.