2020 Laser Market Data

Demand for Industrial Lasers Up 2% in 2020 in Spite of COVID

Low-Cost kW Class Fiber Lasers in China and Pulsed Lasers for Microprocessing Save the Market

24 May 2021

The global market for industrial lasers reached a volume of USD 4.3 billion in 2020. The market is up 2% vs 2019 (USD 4.2 billion), a remarkable increase given the fierce macro-economic background set by COVID-19. Geographically, the increase was mainly due to China. By product segment, the increase was due surging sales of low cost high power cw fiber lasers and, to a lesser extent, due to pulsed lasers for microprocessing.

In 2019, the global market had decreased by 9% vs the peak volume of USD 4.6 billion reached in 2018. The decrease in 2019 was due several factors, including decreased equipment spending in the consumer electronics and automotive industry, which bother are major end markets, a global slowdown in the sector after nearly a decade of continued growth, and especially weak demand in China.

Industrial lasers are used for processing materials in manufacturing. It includes cutting, ablation, joining, welding, additive processes, lithography, as well as a few others with a small market share. The market volumes we report are for lasers. Our market assessment follows the reporting of leading laser manufacturers, which typically includes a small contribution of accessories. Note that including a larger amount of accessories, parts, and service leads to larger sales volumes for the companies involved and a larger market size.

The 2020 market comprises fiber lasers (51% market share), gas lasers (25%), as well as bulk solid state and diode lasers (24%). The share of fiber lasers grew from less than 15% in 2010 to more than 50% in 2020. The substitution of CO2 lasers by fiber lasers was the dominating market trend in the past decade. Today, most gas lasers are used for wavelength specific applications, and the majority of bulk solid state lasers are used for short pulse and short wavelength applications, which are not easily addressed by fiber lasers. At present, major trends in the laser market include a continued price decrease and improved laser parameters, which both lead to an extended range of applications and strong unit growth.

The price of kW class fiber lasers for cutting has decreased substantially in the last five years, from about 30 USD/watt to 10 USD/watt, with Chinese manufacturers offering lasers at half that price. The number of units sold has increased more than tenfold. At present, the market for kW and multi-kW fiber lasers is split into two segments: regular lasers and low-cost lasers priced about 50% lower. Product differentiation of regular lasers includes product and service quality, uptime, and lifetime. Also, increasingly very high power lasers with 6 kW to 10 kW and above are used. The laser power used on high powered flat sheet metal cutters has risen at an annual rate of 10% in recent years.

The new Optech Consulting market report on High Power Lasers (published May 2021) analyzes the fiber laser market and forecast in two separate segments: regular lasers and low cost-lasers.

Industrial Laser Systems Market Ends 2020 with a 2% Decrease

Demand in Asia Grows in Spite of COVID

30 April 2021

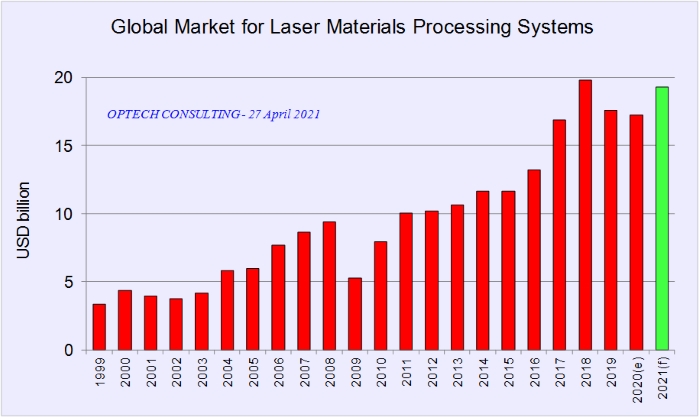

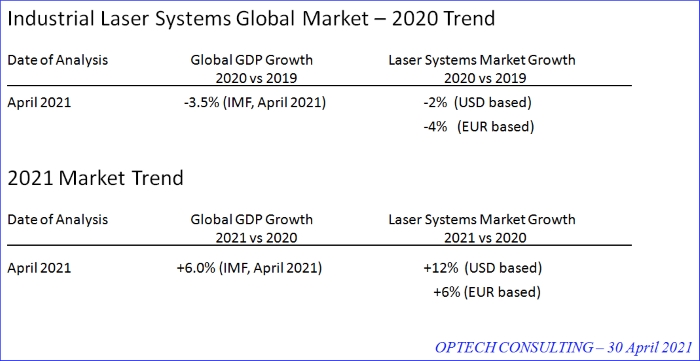

The global market for laser systems for materials processing accounted for USD 17.4 billion in 2020, down 2% vs. the previous year. The decrease is remarably moderate given the macro-economic environment in 2020, which was characterized by a decrease of the global GDP by 3.5% (IMF, April 2021). The moderate decrease of the laser systems market is also in contrast to the sharp 20% decrease of the global machine tool market in 2020.

The global market for laser materials processing systems grew by an accumulated 50% from 2016 to 2018. In 2019 it decreased by 10% followed by a 2% decrease in 2020. The 2021 market indication of USD 19.5 billion corresponds to a 12% increase vs. 2020.

Market Growth In Asia in Spite of COVID

At the beginning of 2020, the industrial laser systems market was in a correction phase, after a decade of continued growth that started in 2010. The correction, which began in the second half of 2018, resulted in a 10% decrease of the industrial laser systems market in 2019 vs 2018. In early 2020, the impact of COVID-19 on the laser systems market was mainly limited to China. In the following months, the economic impact of CIVID-19 spread around the world with the virus. At the same time, however, the economy in China began to recover, and the industrial laser systems market in China even grew in 2020 vs 2019. Also in other parts of Asia the laser systems market increased, including Korea, Taiwan, and several of the ASEAN countries. In contrast, the markets in Europe, Japan, and to a lesser extent in North America decreased because of the pandemic.

The growth of the industrial laser systems market in Asia was driven by consumer electronics. In addition, laser applications in e-mobility added to the market growth, while the broader automotive industry remained at the sideline regarding capital expenditures due to the depressed car market. In China, a major driver of the market increase in 2020 was the revival of rapid adoption of laser technology in manufacturing, a process that started years ago, but came to a temporary halt in 2019.

Industrial Laser Sources Market

The market for laser oscillators for materials processing accounted for USD 4.3 billion in 2020, up 2% vs. the previous year. The increase was mainly due to an increase of the market for low cost kW class fiber lasers in China. — More information on this topic will be added.

Outlook 2021

The demand for industrial laser systems is strongly susceptible to macro-economic cycles. The International Monetary Fund (IMF) has repeatedly upward revised its growth expectations for 2020 and 2021 vs. very low estimates published earlier in 2020. Based on the present forecast of 6.0% global GDP growth for 2021 (IMF, April 2021), Optech Consulting expects that the industrial laser systems market will increase at a double-digit rate in 2021. That estimate is for the USD based growth rate, while the growth rate measured in other currencies is expected to be lower due to the shift of exchange rates from 2020 to 2021.

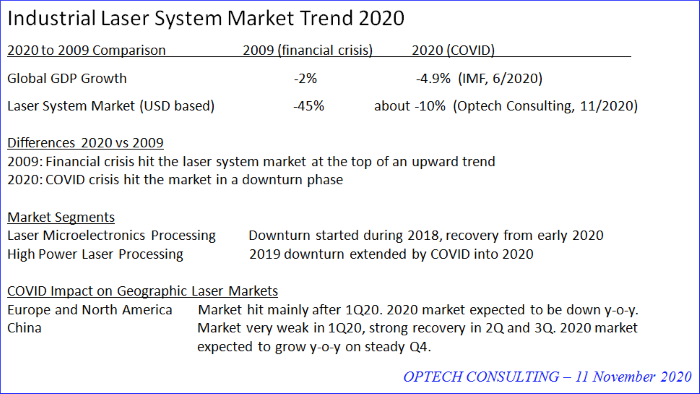

The following information on the 2020 market was published in November 2020. For updated information on the 2020 market please see the newer publications above.

2020 Market for Industrial Lasers and Laser Systems Down 10% – Impact of COVID-19

Published 16th November 2020

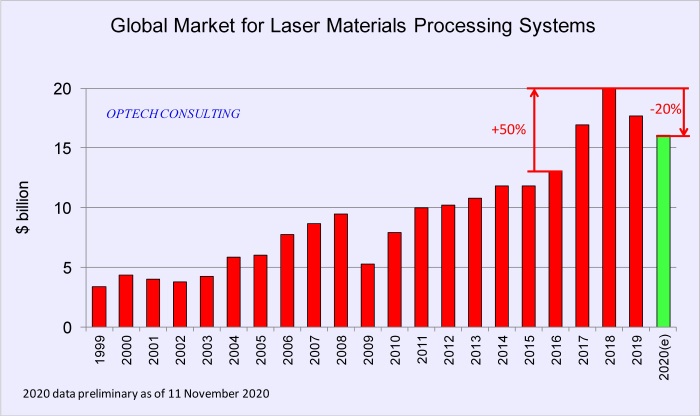

The impact of COVID-19 is one of the most discussed topics in many industries including the laser industry. We searched the internet for quantitative data on the impact, but visiting relevant sites did not reveal data beyond company revenues. In the following, we provide a first estimate for the 2020 global market for industrial laser systems and lasers.

The global market for laser systems for materials processing is expected to reach $ 16 billion in 2020. This corresponds to a decrease by 10% vs the USD 17.9 billion we reported in January for the year before. For industrial lasers we also expect a decrease in the range of 10% and a market volume in the range USD 4.0 billion for 2020. The expected decrease for 2020 appears moderate given the grim macroeconomic environment that developed under the impact of COVID-19. The decrease also appears moderate when compared to the massive decrease of global sales of the machine tool industry this year.

Industrial lasers and laser systems are production equipment. Their demand follows the investment cycles of the end industries. Major end industries for industrial lasers and systems include the 3C industry, and especially the mobile electronic devices industry, the automotive industry, as well as a broad range of end industries for major applications such as cutting and marking.

When we entered 2020, the industrial laser and system market was in a continued downturn trend which started mid 2018. The quarterly sales figures of major industrial laser and system suppliers such as IPG Photonics, Coherent, and Han’s Laser, show strong growth in 2017 and a decrease in the second half of 2018. The downturn in the industrial laser and systems market was triggered by deteriorated economic expectations for major end industries, in particular the automotive and the consumer electronics sector.

Many comments have been made about the role of China in the industrial laser market in the last decade. The Chinese market had lead growth rates for industrial lasers and systems for several years, when it markedly decreased in 2019. The increase was driven by wide adoption of laser processes in Chinese manufacturing in a short time. The decrease in 2019 also is a reaction on the rapid growth in the years before. The decrease came with the above mentioned deterioration in major end industries, the trade conflicts, and the partial shift of foreign manufacturing investments to neighboring countries.

The market condition at the beginning of the year laid ground for the moderate decrease by 10% of the industrial laser market in 2020. The market for laser systems for microelectronics processing – for manufacturing semiconductors, flat panel displays, printed circuit boards, and solar cells – had just started to recover from the downturn in 2019. The recovery in the microelectronics processing segment was not halted by COVID, and demand for laser systems in the segment is expected to grow in 2020. However, other segments of the market for industrial laser systems are expected to decrease in 2020, especially those comprising standard machines adding processing capacity rather than being technology buys. The analysis of all market segments combined leads us to the expectation of a 10% decrease for the industrial laser systems market. For the market for laser sources we expect a similar trend. While the price decay for commodity lasers continues, technology leaders successfully sell higher spec and quality lasers at premium prices. Growth rates for single segments of the industrial laser market are expected to range from double-digit losses for lasers for standard systems to positive growth rates for several segments of microelectronics processing. In China, quarterly sales of the major local laser and system manufacturers have recovered in Q2 and Q3 from the low Q1 levels, laying ground for full year figures which will exceed the 2019. For Europe, North America, and Japan we expect that sales in 2020 will be markedly down.

wth rates for industrial lasers and systems for several years, when it markedly decreased in 2019. The increase was driven by wide adoption of laser processes in Chinese manufacturing in a short time. The decrease in 2019 also is a reaction on the rapid growth in the years before. The decrease came with the above mentioned deterioration in major end industries, the trade conflicts, and the partial shift of foreign manufacturing investments to neighboring countries.