Laser Market Data

Recent Market Information

- 8 January 2026 – Laser Market 2025

- 24 July 2025 – Laser Market 2024

- 2 May 2025 – Industrial Laser and System Market 2024 – Final Data

- 20 December 2024 – Industrial Laser and System Market 2024 – Update

- 2 May 2024 – Industrial Laser and System Market 2024

- 28 December 2022 – Industrial Laser and System Market 2022

- 24 January 2022 – Industrial Laser and System Market 2021

- 24 May 2021 — Industrial Laser Market 2020

- 30 April 2021 — Industrial Laser System Market 2020

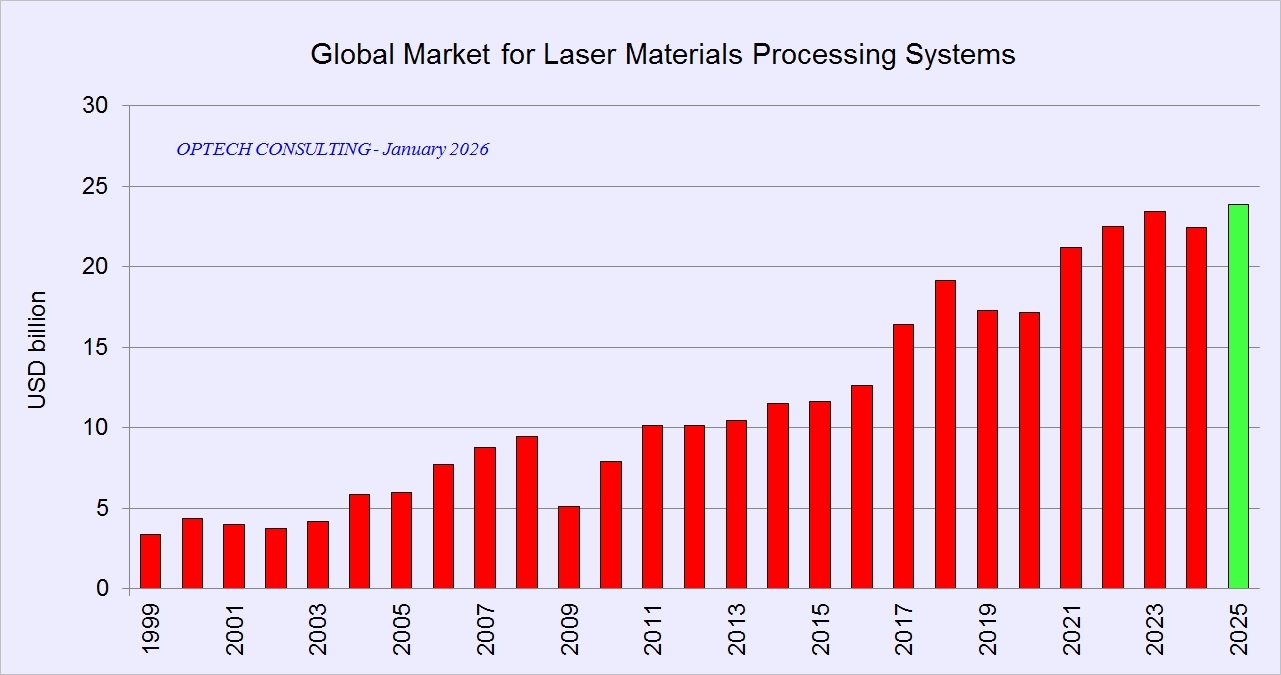

2025 Global Market for Laser Materials Processing Systems at Record High

08 January 2026

The global market for laser material processing systems marked a new all-time high of USD 24 billion in 2025. Based on the data available in January 2026, the market increased vs. the previous year is estimated at by 5% to 7%. Market growth in 2025 was spurred by microprocessing applications in the semiconductor, flat panel display and circuit board industry, with especially strong equipment investments in China. In addition, the demand for laser equipment for EV battery manufacturing recovered from a decrease in the year before. In the high-power cutting systems market, the market weakness extended from 2024 into 2025. At the same time, Chinese exports of laser cutting machines continued to rise, further increasing the challenges for manufacturers outside China.

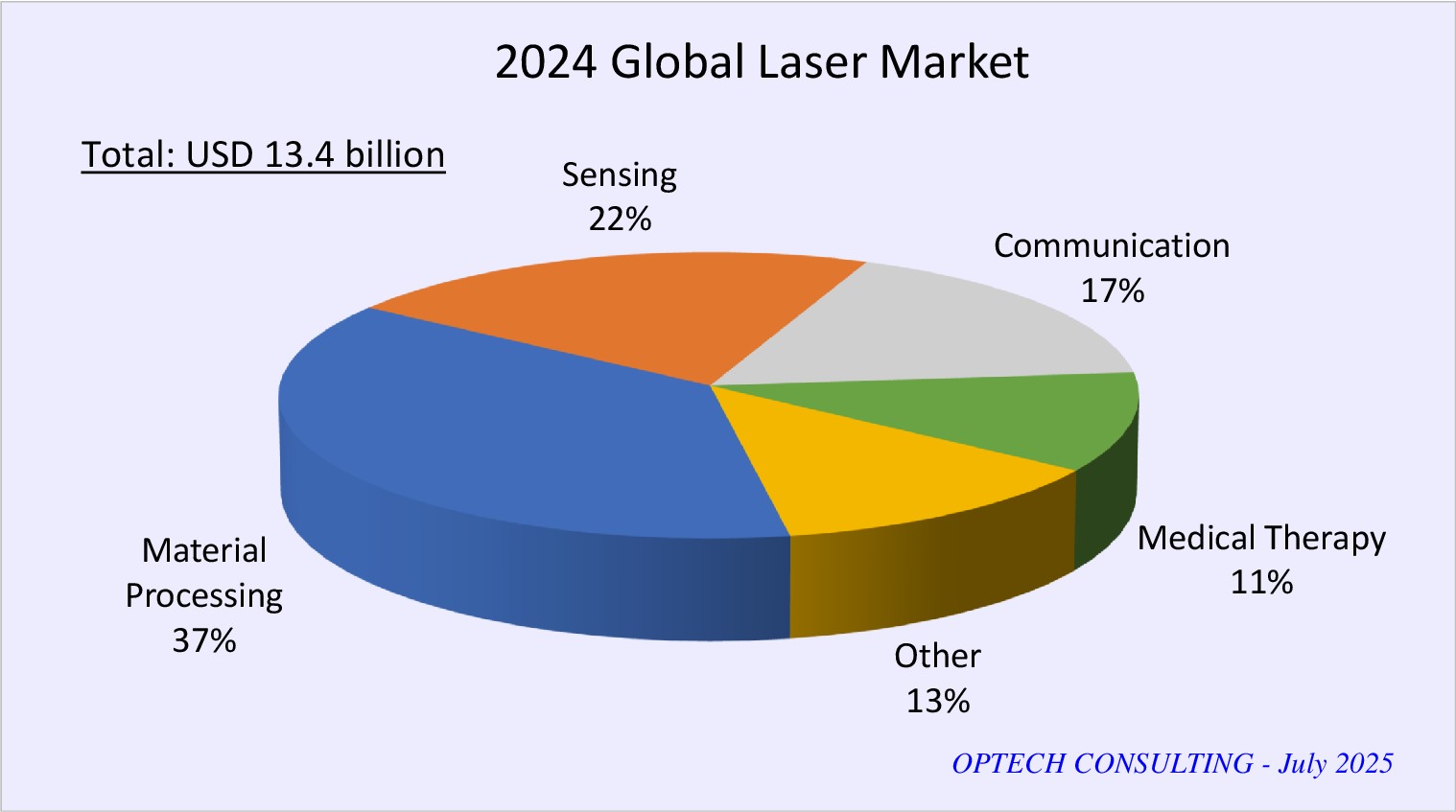

2024 Global Makret for Lasers Accouns for USD 13.4 Billion

24 July 2025

The global market for lasers acounted for USD 13.4 billion in 2024. Lasers for material processing accounted for the largest share of USD 5.0 billion. The segment was decreased by 7.5% in 2024 vs. the previous year due to decreased demand combined with continued price erosion. Lasers for sensing and measurment follow in second place with a market share of 22%. Lasers for communication, medical theraphy, and other applications (consumer electronics and information technology, R&D, defence, ) make up for the balance.

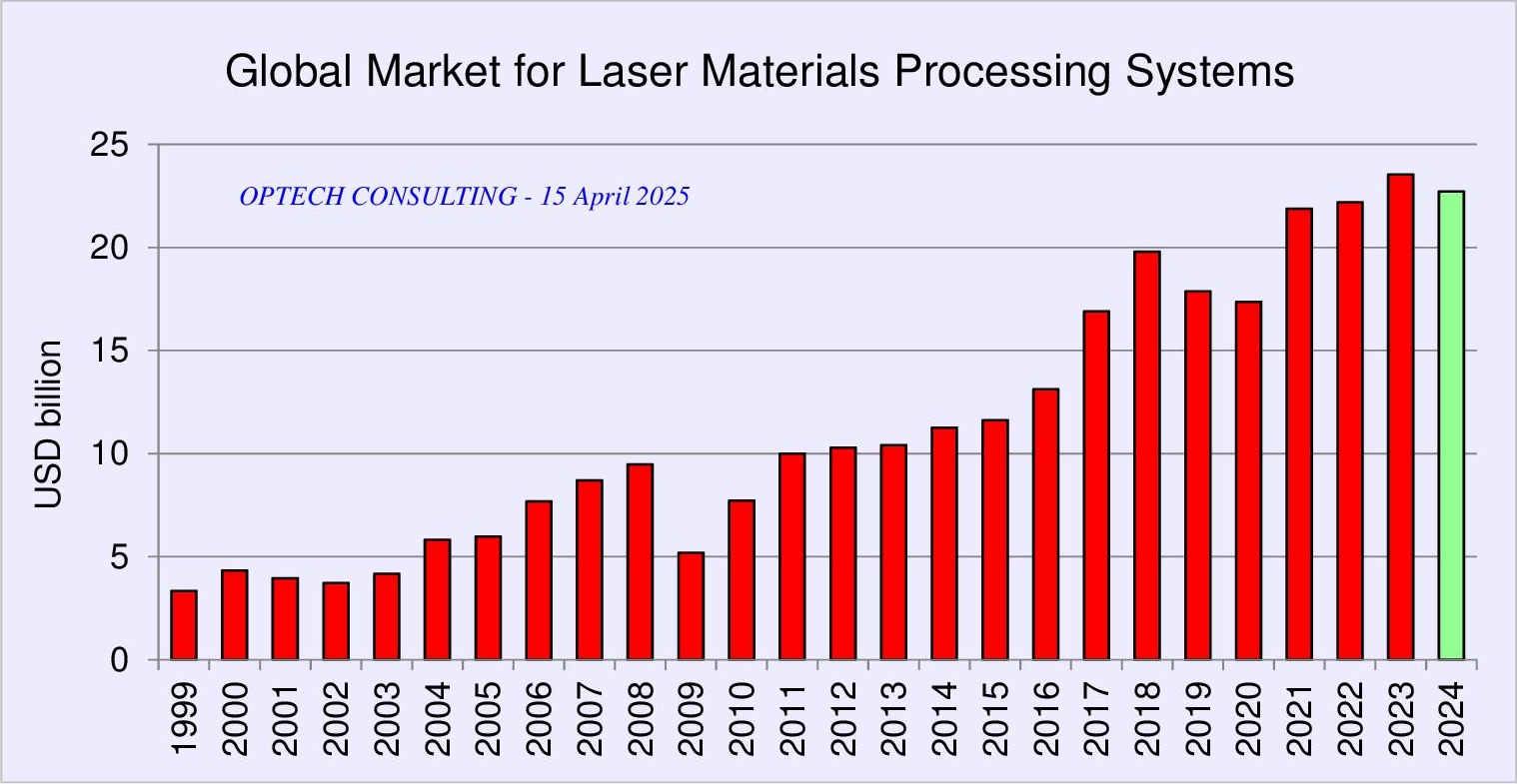

2024 Global Market for Laser Materials Processing Systems Decreased by 4.0%

Demand for Lasers Down 7.5%

02 May 2025

The 2024 market for laser systems for materials processing reached USD 22.5 billion, down from USD 23.5 billion in the year before (-4%). The market for high-power cutting systems decreased as well as the market for market for high-power welding systems, which suffered from decreased demand in e-mobility applications. The latter had driven laser welding in the years before. On the positive side, demand for laser processing systems in microelectronics was mostly up with the exception, however, of the important microlithography segment.

The global market for industrial lasers reached USD 5.0 billion in 2024, corresponding to a 7.5% decline versus the USD 5.4 billion for the previous year. The larger market decrease for lasers as compared to laser systems is due to a decrease of the average selling price. The price decrease follows continued fierce competition by laser manufacturers in China.

For more information on the global markets for laser materials processing please join the 17th International Laser Marketplace held on 26 June 2025 in Munich, Germany. Participation in the symposium is free for visitors of the LASER World of PHOTONICS trade fair.

2024 Market for Laser Materials Processing Systems Decreases Moderately

20 December 2024

The global market for laser materials processing systems reached a volume of USD 23 billion in 2024. The market is moderately down vs. the previous year. The decrease is presently estimated at 1% to 5%, subject to a final adjustment when fourth quarter data and full year data is available. In the previous year, the market edged up by 3.5% to the new record high of USD 23.5 billion.

By geography, only smaller markets showed growth in 2024, particularly in Asia and Latin America. The demand for laser systems was down in North America and in Europe, while the market in China drifted sideways. Of the major application segments, only laser microprocessing advanced in 2024, especially due to increased demand in the semiconductor and flat panel display segments. This lead to a partial recovery of the laser microprocessing market, which had decreased for two consecutive years. Welding, one of the major growth drivers in recent years, suffered from investment reluctance in the automotive industry globally as well as decreasing investments in e-mobility manufacturing equipment in China due to the maturing of the industry. The laser cutting systems market decreased for the second consecutive year worldwide as well as in most of the major geographic markets.

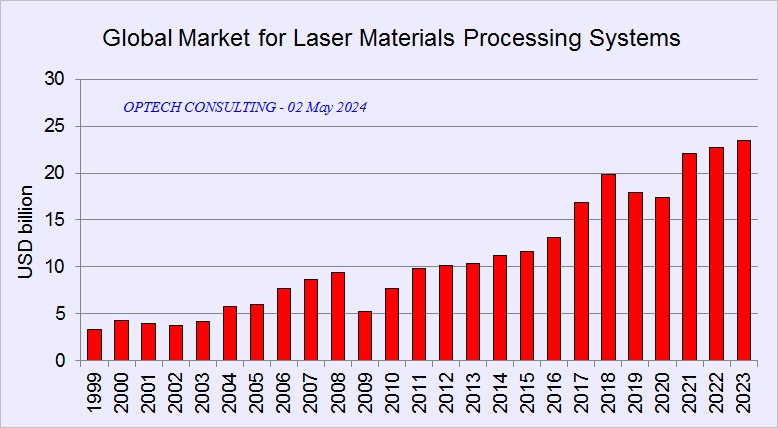

Global Industrial Laser System Market Grew Moderately in 2023 and Reached New Record High

02 May 2024

The volume of the global market for laser systems for materials processing in 2023 is estimated at USD 23.5 billion, corresponding to an increase of 4% vs the previous year. Market growth was led by the Americas (North and South), while growth in Europe and China lagged behind. This refers to the demand market measured in US$. The single market segments, e.g. microprocessing, cutting, welding etc. trended strongly different. The global market for laser sources for materials processing accounted for USD 5.4 billion in 2023.

A market breakout by application and geography, as well as a 2024 market preview are available for our clients. Please contact us.

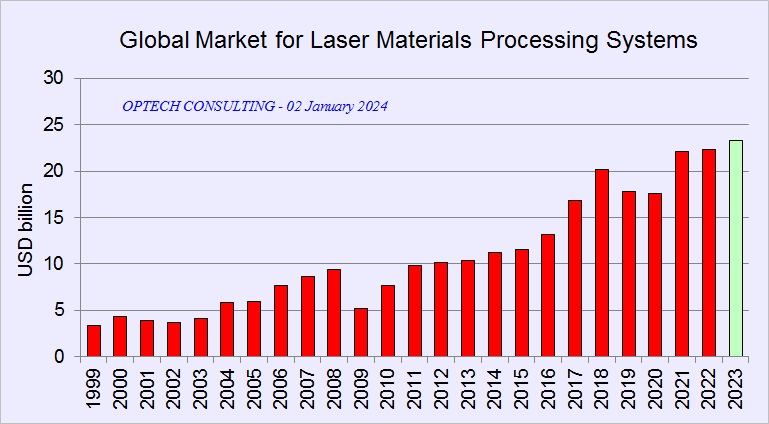

Industrial Laser System Market 2023 – Preliminary Data

02 January 2024

The size of the global market for laser systems for materials processing grew by 2% to 5% in 2023 and reached a new record volume of USD 23 to 24 billion. This preliminary estimate is based on the data available by the end of 2023, which includes financial reports up to the thrird quarter.

Please see also our comments for Photonics Spectra: Trends to Watch in Photonics in 2024

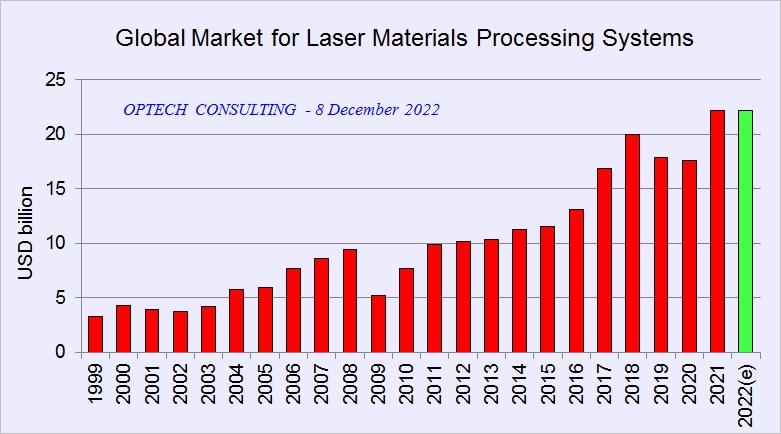

Industrial Laser and System Markets Trend Sideways in 2022

Growth Expected for 2023

28 December 2022

The global market for industrial laser systems trended sideways in 2022. The premininary estimate by Optech Consulting is based on data available by December 2022, which includes the financial reports for the first three quarters of the year. The market reached a volume of USD 22 billion, level with the USD 22 billion reached in the year before when the market surged by 25% (final 2021 figures). The 2022 trend results from diverging developments with robust growth in the Americas and decreased demand in China where the market corrected following a steep increase in 2021. In Europe, demand grew in local currencies, but the dollar value of the market did not increase due to currency effects. The average 2022 value of the euro in USD was more than 10% lower as compared to 2021. By application segment, continued strong growth was recorded for electrical vehicle (EV) and semiconductor manufacturing related laser applications. The 2022 global market for industrial lasers reached USD 5.3 billion, level with the final 2021 value and corresponding to 24% of the laser systems market.

For 2023 Optech Consulting expects growth in the range of 5% to 10% for both the industrial laser and the system market. Continued growth is expected in North America as well as in Europe, while for China, the largest market, visibility is low due to the uncertainties weighing on the economic development.

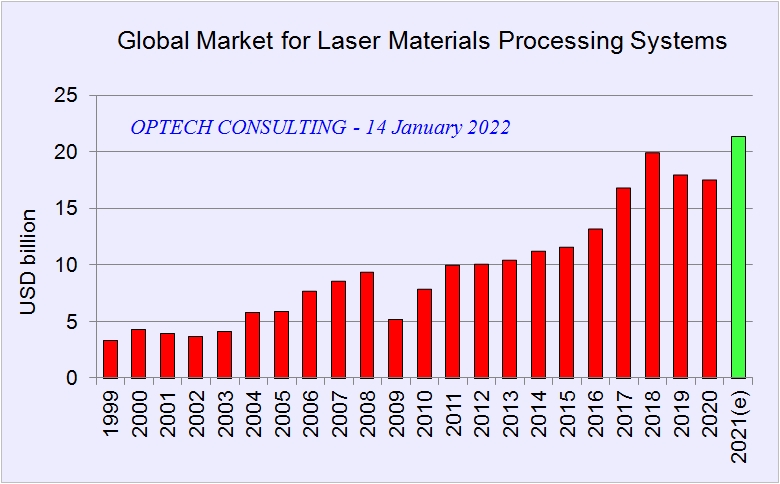

Industrial Laser and System Markets Reach New Record Highs

Increase by 22% in 2021 According to Preliminay Estimate

Published 24 January 2022

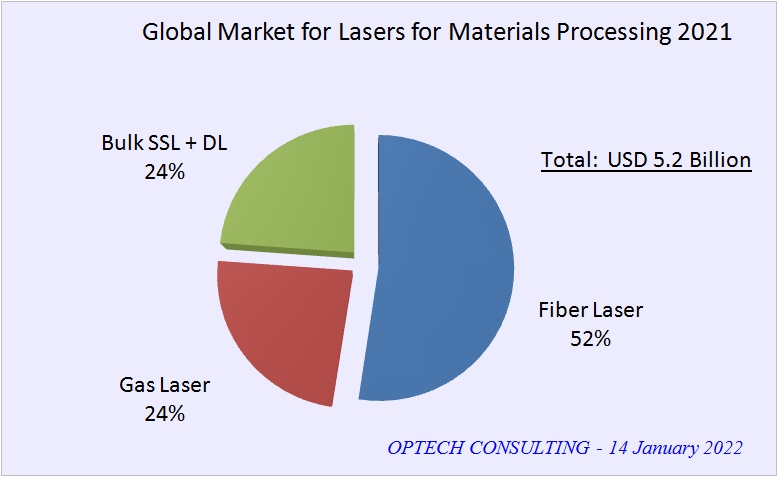

The global market for industrial laser systems reached a new record high of USD 21.3 billion in 2021, up 22% vs. the previous year. The market for industrial lasers also reached a new record volume of USD 5.2 billion in 2021. The estimates are based on data available by mid January 2022, which includes the financial reports of the first three quarters of the year.

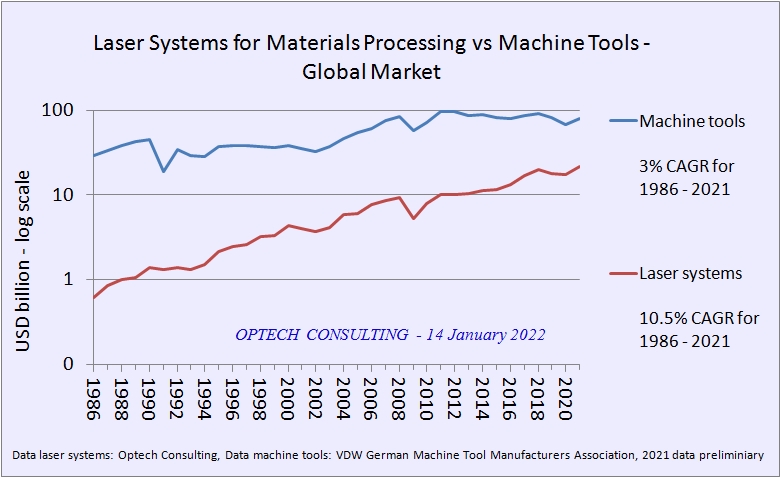

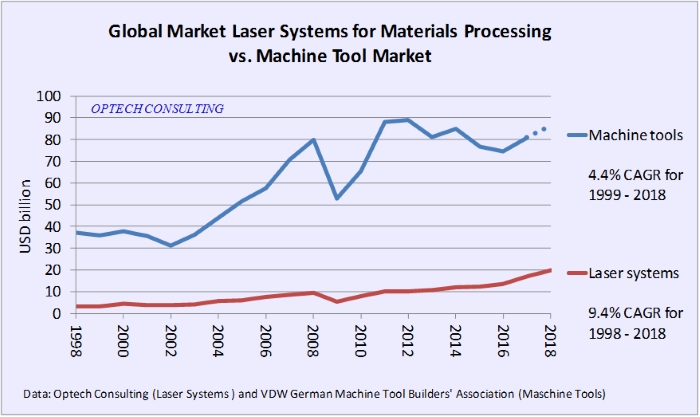

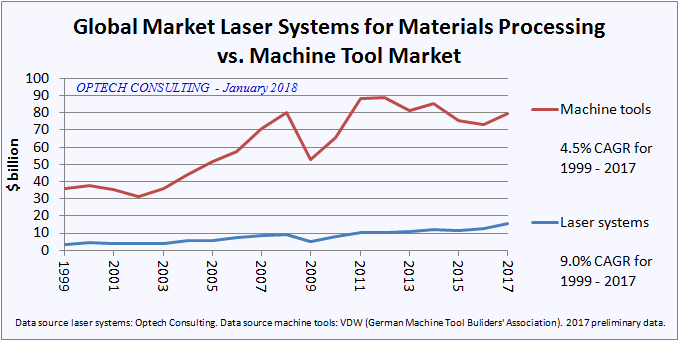

The market for industrial laser systems (laser machines for laser materials processing) increased at an annual average growth rate of 10.5% over the last 35 years. For comparison, the market for machine tools only increased at a rate of about 3% (please see the diagram with the log axis below). During the last 15 years, the laser systems market grew at an average annual rate of 9%. The growth rate is smaller than the average of 13% recorded for the years before. However, until today, the market trend does not indicate saturation.

For more information on the 2021 market plase see 2021 Laser Market Data.

Demand for Industrial Lasers Up 2% in 2020 in Spite of COVID

Low-Cost kW Class Fiber Lasers in China and Pulsed Lasers for Microprocessing Save the Market

Data published 24 May 2021. For more detailed information on laser system markets in 2020 please see 2020 Laser Market Data.

The global market for industrial lasers reached a volume of USD 4.3 billion in 2020. The market is up 2% vs 2019 (USD 4.2 billion), a remarkable increase given the fierce macro-economic background set by COVID-19. Geographically, the increase was mainly due to China. By product segment, the increase was due surging sales of low cost high power cw fiber lasers and, to a lesser extent, due to pulsed lasers for microprocessing.

The 2020 market comprises fiber lasers (51% market share), gas lasers (25%), as well as bulk solid state and diode lasers (24%). The share of fiber lasers grew from less than 15% in 2010 to more than 50% in 2020. The substitution of CO2 lasers by fiber lasers was the dominating market trend in the past decade. Today, most gas lasers are used for wavelength specific applications, and the majority of bulk solid state lasers are used for short pulse and short wavelength applications, which are not easily addressed by fiber lasers. At present, major trends in the laser market include a continued price decrease and improved laser parameters, which both lead to an extended range of applications and strong unit growth.

Industrial Laser Systems Market Ends 2020 with a 2% Decrease

Demand in Asia Grows in Spite of COVID

Data published 30 April 2021. For more detailed information on laser markets in 2020 please see 2020 Laser Market Data.

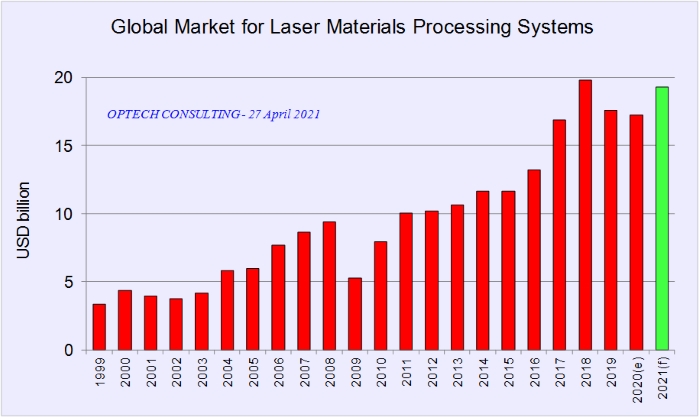

The global market for laser systems for materials processing accounted for USD 17.4 billion in 2020, down 2% vs. the previous year. The decrease is remarably moderate given the macro-economic environment in 2020, which was characterized by a decrease of the global GDP by 3.5% (IMF, April 2021). The moderate decrease of the laser systems market is also in contrast to the sharp 20% decrease of the global machine tool market in 2020.

The global market for laser materials processing systems grew by an accumulated 50% from 2016 to 2018. In 2019 it decreased by 10% followed by a 2% decrease in 2020. The 2021 market indication of USD 19.5 billion corresponds to a 12% increase vs. 2020.

2019 Laser Materials Processing Systems Market Reaches $ 17.9 billion, Down 9%

Data published 10 January April 2020. For more detailed information on laser and laser system markets in 2019 please see 2019 Laser Market Data.

The global market for laser systems for materials processing reached a volume of $ 17.9 billion in 2019, down 9% vs the previous year. The 2019 market estimate is based on data for the first three quarters and company guidances for the fourth quarter. The decrease in 2019 follows nine years of continued growth. The industrial laser systems market grew from $ 5.3 billion in 2009 to a record volume of $ 19.8 billion in 2018. In 2017 and 2018 alone the market increased by 50% due to a combination of drivers including the rapid adoption of laser manufacturing in China, a market push by decreased laser prices, and an end market pull in the consumer electronics and automotive industry.

Continue reading: 2019 Laser Materials Processing Systems Market Reaches $ 17.9 billion, Down 9%

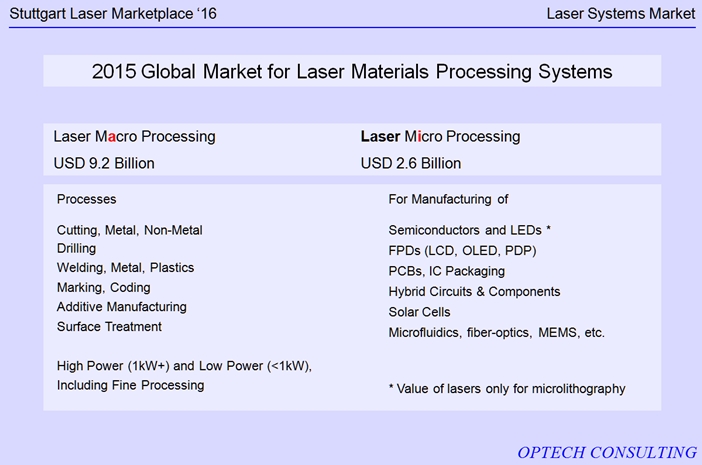

Laser Market Overview

Optech Consulting covers the laser market since 1992. The data in our market reports is based on primary market research and numerous discussions with companies, worldwide.

Below, we provide aggregated data from our market research.

The following definitions apply:

- A “laser source” is a laser.

- A “laser system” is a system (machine) including a laser.

- Exception: For microlithography we count the DUV or EUV light source as the system. We do not include the full value of the wafer stepper/scanner.

Global Market for Lasers and Laser Systems for Materials Processing 2024

| USD Billion | |

| Global market for industrial lasers | 5.0 |

| Global market for industrial laser systems | 22.5 |

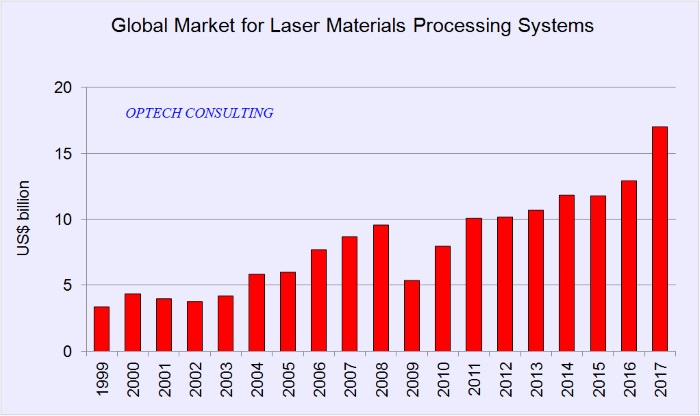

Global Market for Laser Systems for Materials Processing by Year, in USD Billion and in EUR Billion

| 1986 | … | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

| World Market in EUR Billion | 0.69 | 6.1 | 6.35 | 6.4 | 3.8 | 5.9 | 7.2 | 7.9 | 8.0 | 8.8 | |

| World Market in USD Billion | 0.64 | 7.7 | 8.7 | 9.4 | 5.2 | 7.9 | 10.0 | 10.2 | 10.7 | 11.8 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024* | |

| World Market in EUR Billion | 8.8 | 10.7 | 11.7 | 15.0 | 16.8 | 15.9 | 15.3 | 18.7 | 21.4 | 21.8 | 20.8 |

| World Market in USD Billion | 11.8 | 11.8 | 13.0 | 16.9 | 19.8 | 17.9 | 17.4 | 22.1 | 22.7 | 23.5 | 22.5 |

| * Final data |

2018 Market for Lasers and Laser Systems for Materials Processing

Please follow the link for more information on the 2018 market.

2017 Market for Lasers and Laser Systems for Materials Processing

The following diagrams show historic market data.

Please leave us a message. We will come back to you shortly.

Please leave us a message. We will get back to you shortly.